Long before the launch of the Hustler Fund on 30 November 2022, I already knew I wanted to test the Fund out. I was particularly drawn to the experiment for two reasons; the Fund had been making headlines during the campaigns and after the August 9 polls. The Fund (not loan) that served as an anchor to the hustlers’ narrative that was the centrepiece of President William Ruto’s campaign promised to reward low-income earners, “hustlers”, by giving them access to interest-free credit, liberating them from predatory lenders in the process. And even though in the time between campaigns and the launch Kenya Kwanza reneged on its interest-free promise, the Fund has still attracted so much buzz (positive and otherwise). The second reason was that I just happen to be an overly curious human being.

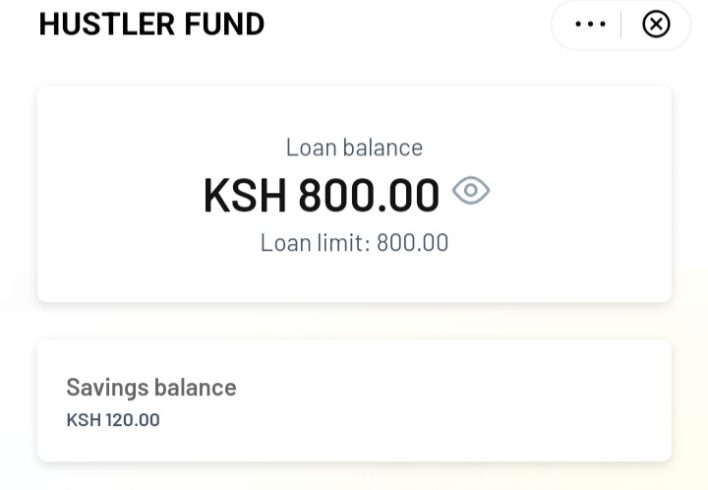

As one of the 15 million Kenyans who have so far borrowed from the Hustler Fund, I can barely tell you what I spent that money on. The measly 800 bob that I got flowed unnoticeably into my M-PESA account and then fizzled out quickly. After that initial stab, I went back and borrowed from the platform two more times, the third time coming immediately after President Ruto promised – while addressing those in attendance of the Kenya Police Sacco 50th Anniversary Celebrations and opening of the Police Sacco Stadium in South C on 3 February – that loan limits would be increased effective that midnight.

However, despite making all repayments promptly, my loan limit is yet to increase.

But this is just a brushed-over account of my experience.

Let’s dig into my two months of experiencing the Hustler Fund.

The Curious Cat

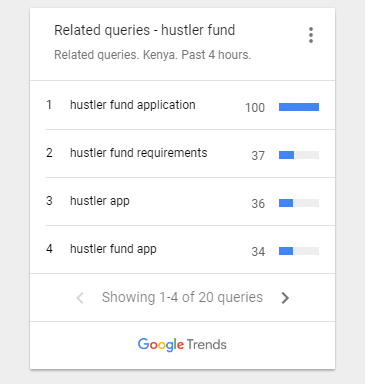

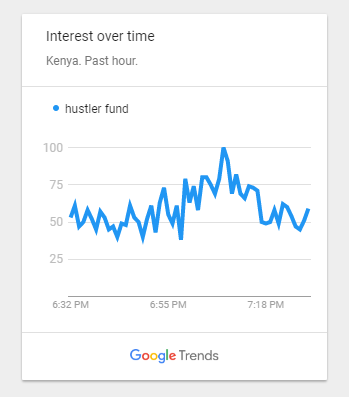

On the day of the Hustler Fund launch, while catching the fanfare at the Green Park Bus Terminus in Nairobi on TV, I kept tabs on the goings-on on social media, more specifically Twitter mentions. For the better part of the day, the top trending hashtags oscillated between #PresidentRuto, #GreenParkTerminus, #Hustlerfund and #Fuliza, the latter owing to its lending model being equated to the Fund. And well after the action on TV fizzled out and the Fund was officially green lighted, I sought to look at how much traffic the mentions had built up on Google, my go-to platform being Google trends.

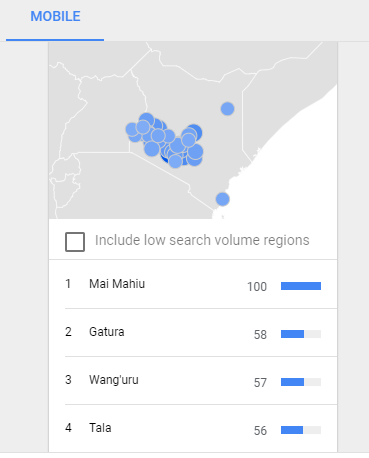

The top search engine painted a very interesting picture of who was interested in the funds and the queries posed. Hustler Fund (and its related queries) was among the key top searches on Google. Queries moving from the “what is” to the “how to”. How do I access hustler funds? Can an individual apply for hustlers (sic) fund? Hustler fund registration and How to apply (sic) hustler fund. One other interesting detail was the locations that topped the search queries. The Rift Valley, Nairobi and parts of Central Kenya made up the bigger share of where the searches originated.

The Experiment: Pin Yako Sio Siri Yako

After an afternoon (and some part of my evening) of trailing the data and being entertained by memes of people sharing their loan limits, I jumped on the chance to try the fund out. At first, I used the prescribed USSD code *254#. From the FAQs page on the Hustler Fund website, there are three key ways to access the fund. First, through the hustler fund app, then either through the USSD code or mobile money APP platforms of any of the three Mobile Network Operators in Kenya—Safaricom (M-PESA), Airtel (Airtel Money), and Telkom (T-Kash).

The registration process was easy to follow, a few steps and you are in. A red flag though was the platform seeking my M-PESA pin before initialising the registration, much against what Safaricom advises on sharing one’s M-PESA secret code. Though concerning, I was on a mission and chickening out was not an option. Besides, one cannot complete the sign-up process without inputting the M-PESA PIN, and therefore I didn’t really have a choice.

Purportedly, the PIN is supposed to be the primary authenticator given the high level of fraud in mobile money, where people can maliciously use your phone to borrow money from digital lenders. But by inputting my PIN, I was consenting to giving the platform permission to receive, record, disclose or utilise personal information held by my service provider, Safaricom in this case. Within moments of keying in the M-PESA PIN, I received a prompt message relaying that the registration was successful and a confirmation would be shared within two hours of receiving the message. That wasn’t to be.

I decided to try the M-PESA app.

Although I had registered through the USSD, I had to go through the registration process all over again, which was strange since I imagined the system must have picked up my initial registration attempts (if not full registration). But given it was day one, a buggy system was excusable. The sign-up steps on the M-PESA app were similar to those I had encountered using the USSD, the only perk being that the M-PESA app route was quicker and I got the loan limit message within minutes of making the request.

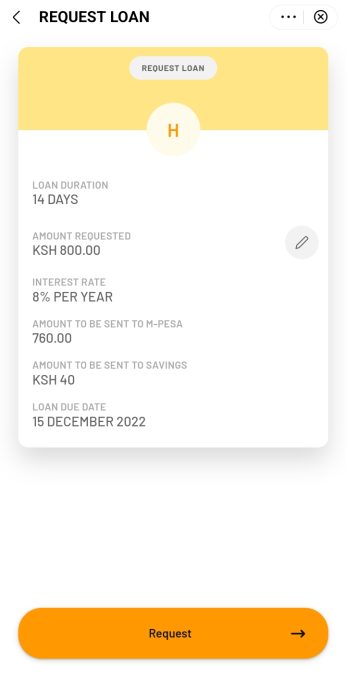

Shock on me, my loan limit was KSh 800 (I thought it’d be higher 😅).

The loan limit is supposedly pegged on one’s credit score, and as per the Fund’s Terms and Conditions, the limit is decided through data derived from one’s M-PESA service use history.

There is, however, no elaborate explanation as to how they arrive at the limit.

The next step was to make the loan request.

At the first attempt of making the loan request, the app was buggy and so I suspended the exercise to later in the day. At around 9.00 a.m. on the morning of 1 December 2022, I gave the process another shot. I got lucky this time. Within minutes, my M-PESA account was credited with KSh 800, the full loan amount.

However, before I could blink, the 14-day loan period was over, and it was time to repay, but not before getting spammed. In between the time I got the loan and when I repaid it, I was constantly bombarded with reminders through text messages, to pay the loan.

At the time of payment, interest on the loan had accrued to KSh 2.45, bringing the total amount to be repaid to KSh.802.45. The daily interest rate charged was about 0.002 percent—the annual loan interest of eight percent is computed on a prorated basis.

Daily interest rate= 8% (Per Annum) = 0.0219%

365

Interest after 14 days 0.0219%*800*14= 2.4528

Total Loan Repaid: 2.4528+800= Ksh 802.45

The payment process in itself was easy. I opted to use the USSD code. From the repayment menu, one can pay the loan amount in full or partially. There is also an option to settle someone else’s loan. The platform, however, still prompts for the M-PESA PIN when making payment. In my case, the full loan amount was deducted and KSh 40 credited to my ‘savings account’. Interestingly, the Hustler Fund has a saving component that is furnished through deductions made from the loan advanced. This is set at five percent of the borrowed amount, and from this deduction, 30 percent is extended to a short term savings account while 70 percent is transferred to an undisclosed pension scheme.

Keeping Up With The Numbers

As I experimented with the Fund itself, I was still keen on tracking the data relating to it. Hustler Fund’s (officially the The Financial Inclusion Fund) selling points has been the low annual interest rate (8%), no collateral, no listing on Credit Reference Bureaus (CRB) and no dreadful loan sharks with threatening calls as has been the case with some digital credit lenders. According to a press release from the Ministry Co-operatives & Micro, Small and Medium Enterprises( MSMEs), the fund was meant to correct the credit market that has been denying people at the bottom of the economic ladder loans by demanding collateral and charging exorbitant rates. As such, I wanted to observe how many people would sign up for the Fund. By 4:00 p.m. on 1 December 2022, a day after the launch, 1.6 million Kenyans had signed up and KSh 413 million disbursed. That number has since grown to 18.5 million opt-ins and KSh.16.5 billion in disbursed funds as at 30 January 2023—the last update from the Co-operatives & Micro, Small and Medium Enterprises Cabinet Secretary, Simon Chelugui .

As at today, under the Hustler Fund we have Disbursed 16.5B, Repayment 8.1B, Opt-ins 18.5M, Savings 826M, Repeat customers 6M pic.twitter.com/9d05WLoMbW

— Simon Kiprono Chelugui, EGH (@CsChelugui) January 30, 2023

A second data set of interest to me was the repayment rate.

For starters, from interacting with the FinAccess Household Survey of 2021 by the Central Bank of Kenya (CBK), the FSD (Financial Sector Deepening) Kenya and the Kenya National Bureau of Statistics (KNBS), I had learnt that mobile lending platforms attracted the highest number of loan defaulters. Furthermore, statistics from the FinAccess Household Survey County Perspective released in November 2022 posited that financial health rather than access was Kenya’s biggest financial challenge. Also given the default rate of similar affirmative funds such as the Youth Enterprise Development Fund and Uwezo Fund, I was eager to see if the Hustler Fund would be met by similar fate. Incidentally, in the first days after the Fund had launched, I happened to meet a group of young men at the kibanda I frequent for lunch, who when discussing the Fund had mentioned that they all intended to borrow from the Fund but not repay the money.

An update from President Ruto on 3 February 2023 made it known that of the KSh 16.5 billion disbursed through the Hustler Fund, KSh.8.1 billion had been repaid and only 800,000 loanees were yet to settle their debt.

President @WilliamsRuto commits to increase the Hustler Fund Limit tomorrow. pic.twitter.com/ptaI1lZv01

— Hussein Mohamed, MBS. (@HusseinMohamedg) February 3, 2023

After all is said and done, what I have found puzzling in the Hustler Fund-related data in the two months that the Fund has been in operation is the reporting and collation of data. The periodic updates of the Fund are shared on social media either through the twitter handles of the Co-operatives & MSMEs Cabinet Secretary Simon Chelugui, the State House Spokesperson Hussein Mohamed or the infamous HNIB Spokesperson Dennis Itumbi, the Hustler Fund facebook page (that was last updated on 26 January 2023), or shared through the President’s speeches. There is no existing database on either the National Treasury website, the Co-operatives & MSMEs website nor the Hustler Fund website that compiles the Fund’s data. Whether this is intentional or an oversight on the Fund operators part remains a puzzle.

UPDATE;

— -Dennis Itumbi (@OleItumbi) December 1, 2022

1st December, 2022

Hustler Fund disbursed amount as of 1600hrs today – Shs. 413m disbursed.

Hustler Loan Repayments – Shs. 7.7m.

Total Number registered /Opt-ins/ 1.6m.

The @WilliamsRuto REVOLUTION is on, benefiting millions of Hustlers already!#HustlerFund

In the coming days, I look forward to testing out the second tranche of the Fund, the Hustler Fund Micro Credit, which is to launch at the end of the month and will facilitate borrowing through Saccos and Groups. The Hustler Fund is designed to provide credit through four products: personal finance, micro, small and medium sized enterprise (mSMEs) loans and start-up loans. The first of the four products, the personal finance loan, was what was launched on 30 November 2022 with its funds being provided by commercial lenders KCB Bank and Family Bank and distributed through the three mobile money platforms.